Will I get recognised experience for TPB purposes?

Yes. All supervised work through TAP is certified and compliant with TPB’s registration requirements.

Can I bring my own clients?

Absolutely. Your clients remain yours. We don’t compete—we support.

Is there a contract or lock-in period?

No. TAP Membership are month-to-month and cancellable anytime.

What if I need help with a return?

Our tax professionals are here to review your work, answer questions, and provide practical guidance. Expert face-to-face training is also available for an additional fee.

Do I trade as own my own entity?

Yes. You trade under a business name selected by you. Our supervision is not obvious to your clients.

How long does it take?

You will require up to 1800 hours of supervision and you may need to obtain certain qualifications (as specified by the TPB obtainable for an online training college) subject to the qualifications you already have obtained. But you will be in practice immediately.

How long before I can start building my client base?

You can start immediately. If you already have bookkeeping clients the best place to start would be converting those into tax clients. You can go to work on converting your own database of business and personal contacts into paying client.

Where do I get my leads?

We are not a franchise we are a service provider. However our partner company Tax Agent Media can assist you with marketing and media services at an additional cost. Find out more at www.taxagentmedia.com.au

Do I get guidance?

You get guidance and experience from the direct review and supervision of the returns you prepare. You also get access to our technical resources to assist you with general questions that may arise. Most importantly you become part of the TAP community of professionals.

Is it a franchise?

No. This will be your own business, using your own name. We are helping you build your practice. But in many respects you get the support systems common to the best of franchises.

What is included in the purchase price of the Program?

- Assistance in setting up your internal tax and accounting systems;

- Initial training in our procedures and getting you started;

- Access to the Tax Portal;

- Access to our help line for tax and practice management issues.

What other costs will my new practice incur other than the purchase of your Program?

- There is an entry fee and we will charge a fee as a percentage of your tax lodgement revenues (not your existing revenues) from your practice to cover our detailed review of all your tax submissions for your clients prior to lodgement. It is to cover the supervision of your tax work in accordance with TPB regulations. This fee also covers tax preparation help via email and the lodgement of all your tax work;

- Tax system subscription fees (this varies depending on how many clients you have);

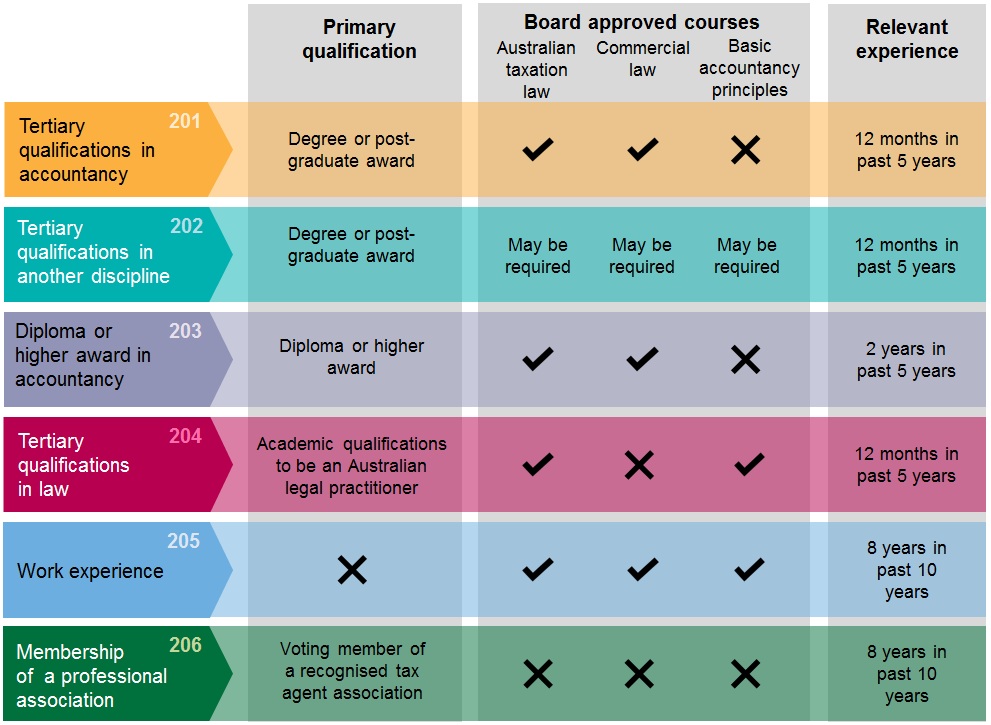

- Recommended Tax Agent’s course or BAS Agent’s course (one year online paid directly by you to the training service provider). A tertiary tax/law course may also be required depending on your existing qualifications (see the TPB chart below) which can also usually be complete within the three year period and can be obtained through online education (the cost of which will be to your account);

- Any social media marketing or advertising in general will be to your account;

- Computer equipment;

- Up front fee for membership.

What are the TPB qualification requirements?

Book a personal consultation.

Call us today on 03 8456 7070